Optimize Your Gains on the Wowbit Trading Exchange out there

Optimize Your Gains on the Wowbit Trading Exchange out there

Blog Article

Mastering the Art of Trading Exchange: A Comprehensive Exploration

In the world of trading exchanges, navigating the detailed web of market dynamics and technical evaluation can be an awesome obstacle for also one of the most skilled capitalists. As the monetary landscape proceeds to progress and new opportunities arise, there is a growing need for investors to sharpen their approaches and skills to stay ahead of the curve. From recognizing the subtleties of different exchange kinds to properly handling dangers and leveraging cutting-edge tools, understanding the art of trading is a diverse journey that requires thorough interest to detail and a deep understanding of the ever-shifting market pressures. By checking out the complexities of this domain, investors can unlock a world of possible and possibilities that can form their success in methods they never imagined.

Recognizing Market Dynamics

One trick facet of market dynamics is the concept of supply and demand. When there is a high need for a certain asset and limited supply, costs have a tendency to climb as customers compete for the scarce resource. On the other hand, when supply exceeds need, rates are most likely to drop as vendors seek to unload their excess holdings - trading market. This consistent conflict in between sellers and buyers shapes the price movements seen on trading exchanges.

Moreover, market dynamics are additionally affected by external variables such as federal government policies, reserve bank policies, and international economic fads. Investors must stay notified regarding these external impacts to expect possible market shifts and make knowledgeable trading choices. By mastering the understanding of market dynamics, traders can acquire a competitive side in the busy globe of trading exchanges.

Mastering Technical Evaluation

In the world of trading exchanges, efficiency in technical analysis is a pivotal ability for traders looking for to improve their decision-making capabilities and optimize their trading performance. Technical analysis entails studying historic market data, mostly rate and volume, to anticipate future price motions. Investors use numerous tools and methods, such as graph patterns, indicators, and oscillators, to determine fads, support and resistance degrees, and possible entry and departure factors.

One basic aspect of grasping technological evaluation is understanding the importance of various graph patterns. Patterns like head and shoulders, double tops and flags, triangles, and bottoms can supply beneficial insights into potential cost motions. In addition, understanding the analysis of indicators such as moving averages, Relative Strength Index (RSI), and MACD can help traders make educated choices based upon market momentum and overbought or oversold problems.

Executing Danger Monitoring Approaches

Competent investors identify the critical relevance of executing efficient threat management methods to guard their capital and browse the uncertain nature of financial markets. These orders immediately activate a sale when a security reaches an established rate, aiding traders reduce dangers (copytrader). Overall, executing a thorough threat management plan is important for investors to browse the uncertainties of the market and secure their hard-earned funding.

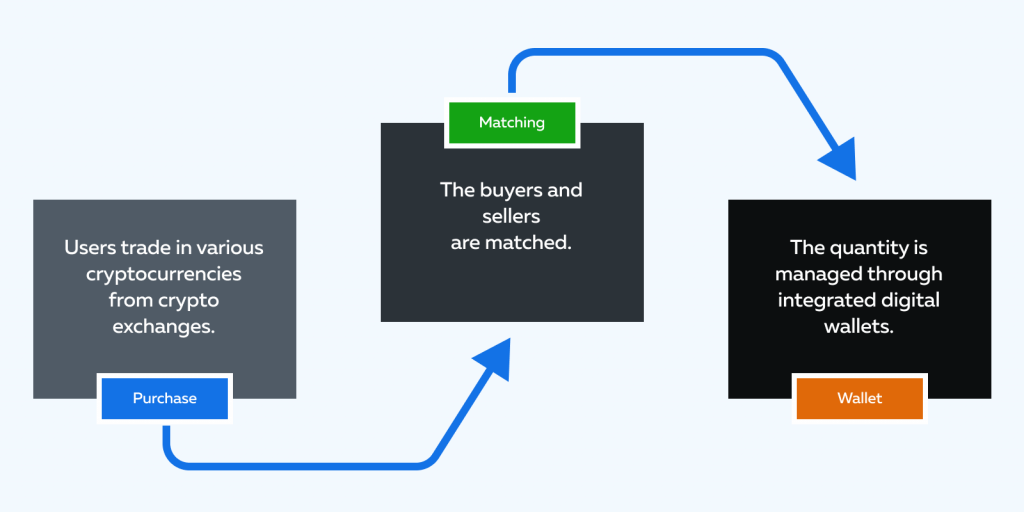

Discovering Different Exchange Kind

Efficiently navigating the realm of trading includes a nuanced understanding of the diverse kinds of exchanges offered to financiers. These exchanges play a critical role in facilitating the buying and selling of financial instruments, offering a platform where market participants can interact. One of the most usual kinds of exchanges is the typical stock market, where equities of openly detailed business are traded. These exchanges operate within a centralized marketplace and abide by specific rules and regulations to make certain orderly and fair trading.

Recognizing the qualities and capabilities of different exchange kinds is essential for financiers looking to diversify their trading approaches and maximize numerous market opportunities.

Leveraging Trading Tools and Modern Technology

Having acquired understanding into the diverse sorts of exchanges readily available to investors, the next action is to discover the strategic use of trading devices and modern technology to enhance trading effectiveness and decision-making procedures. In today's vibrant trading landscape, technical developments play an essential duty in encouraging traders to make informed decisions quickly and successfully. From mathematical trading systems to advanced charting tools, traders have access to a broad variety of sources that can simplify their trading tasks and boost their total efficiency.

One trick advantage of leveraging trading devices is the capacity to automate recurring jobs, allowing investors to concentrate on high-value tasks such as assessing market trends and developing trading strategies - best stock trading. In addition, advanced analytics devices can supply investors with useful understandings into market habits, assisting them identify potential opportunities and risks more efficiently

In addition, trading modern technology makes it possible for investors to carry out trades with greater speed and precision, lowering the probability of errors and optimizing revenue capacity. wowbit trading exchange. By using the power of trading tools and innovation, traders can stay in advance of the curve in today's fast-paced markets and attain their trading objectives with higher precision and confidence

Final Thought

Finally, understanding the art of trading exchange needs a deep understanding of market characteristics, technological analysis, danger management approaches, and different exchange kinds. By leveraging trading tools and modern technology successfully, traders can improve their decision-making process and boost their chances of success in the affordable trading navigate to this site landscape. It is important for investors to continuously enlighten themselves and adapt to the ever-changing market conditions in order to grow in the trading atmosphere.

In the world of trading exchanges, proficiency in technological analysis is an essential ability for traders looking for to boost their decision-making abilities and optimize their trading performance.Having gotten insight into the varied kinds of exchanges available to financiers, the following step is to check out the critical utilization of trading tools and modern technology to enhance trading effectiveness and decision-making procedures. From mathematical trading platforms to sophisticated charting devices, investors have accessibility to a wide variety of sources that can simplify their trading activities and enhance their general efficiency.

In verdict, mastering the art of trading exchange requires a deep understanding of market dynamics, technical evaluation, threat monitoring strategies, and different exchange types - trading. By leveraging trading tools and innovation successfully, investors can boost their decision-making procedure and raise their opportunities of success in the affordable trading landscape

Report this page